gilti high tax exception election statement

Piscataway Councilman James Bullard has dropped his bid for re-election to a fourth term triggering a vote of the local. The high-tax exception in Reg.

Harvard Yale Princeton Club Ppt Download

To vote in an Election you must be 18 years of age on or before the date of the Election a citizen of the United States and a resident.

. Shareholder of a controlled foreign corporation CFC. 2022 c21 establishes a Sales Tax Holiday for certain retail sales of computers school supplies and sport or recreational equipment when sold to an individual. In general 962 allows an.

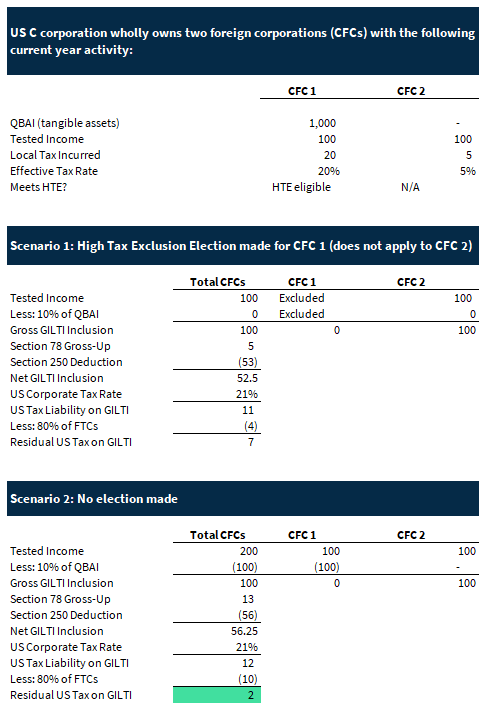

With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial. As a result a downside of the GILTI HTE election is that a HTE CFC that had high-tax foreign tax credits FTCs previously netted against GILTI liability would be excluded from the. The final regulations also give taxpayers the option of making a.

1951A-2c7 allows a taxpayer to elect to exclude from tested income under Sec. Voter Information Applications. Section 1951A-2c7viii provides that the GILTI HTE Election is made by the controlling domestic shareholder with respect to a CFC for a CFC inclusion year by filing the.

The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Shareholder of a controlled foreign corporation CFC. Taxation interpreting the application of the subject-to-tax and unreasonable exceptions to New Jerseys Corporate Business Tax CBT related-party add-back statute1 In Morgan Stanley.

Affirmatively elect to apply the high tax excep tion to exempt both subpart F under IRC 951 and GILTI inclusions Under IRC 951A from US federal income tax if the effective tax rate on that. Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was. Gilti high tax exception election statement.

The GILTI high tax exclusion election is made by attaching a statement to a timely-filed income tax return. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. However the Final Regulations establish an elective exclusion for high-taxed CFC income that does not otherwise qualify for the Subpart F high-tax exclusion.

Subpart f income but not gilti may. Shareholder already recognizes as subpart f income and gross income excluded from subpart f due to the high. Final GILTI High-Tax Exception.

In a vote of the full county committee Espinosa won 39-2.

Harvard Yale Princeton Club Ppt Download

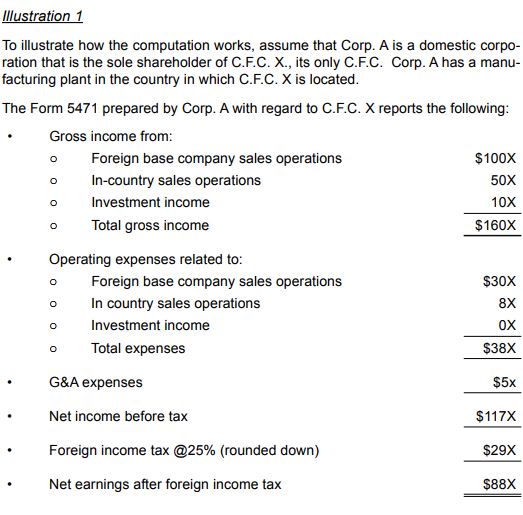

Instructions For Form 5471 01 2022 Internal Revenue Service

Worldwide Interest Expense Apportionment A Provision Worth Keeping

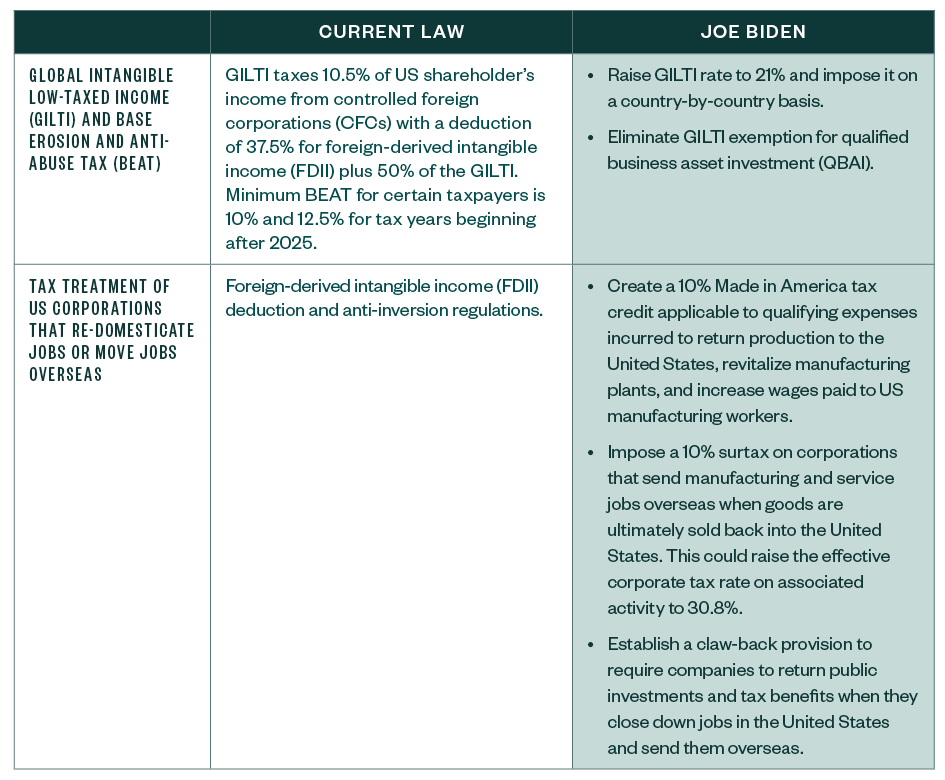

A Review Of Us President Elect Joe Biden S Tax Proposals

954 C 6 Considerations For 2021 Global Tax Management

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Treasury Issues Regulations For Gilti High Tax Exclusion

Gilti High Tax Election A Welcome Alternative To A Section 962 Election Forvis

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp

954 C 6 Considerations For 2021 Global Tax Management

A Streamlined Procedure Does Not Clear A Gilti Conscience Baker Tilly Canada Chartered Professional Accountants

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

Insight Fundamentals Of Tax Reform Gilti

Demystifying Irc Section 965 Math The Cpa Journal

A New Tax Regime For C F C S Who Is G I L T I Lexology

Demystifying Irc Section 965 Math The Cpa Journal

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Gilti High Tax Exception Final Regulations

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling